Earn up to 13% passively investing in real estate projects — no hammers required.

Diversify and expand your portfolio with wealth-generating residential real estate investments, underwritten and originated by our analyst team.

Why passively invest with Upright?

- Create an account and complete your profile as an accredited investor.

- Read the Private Placement Memorandum and associated sample investor documents.

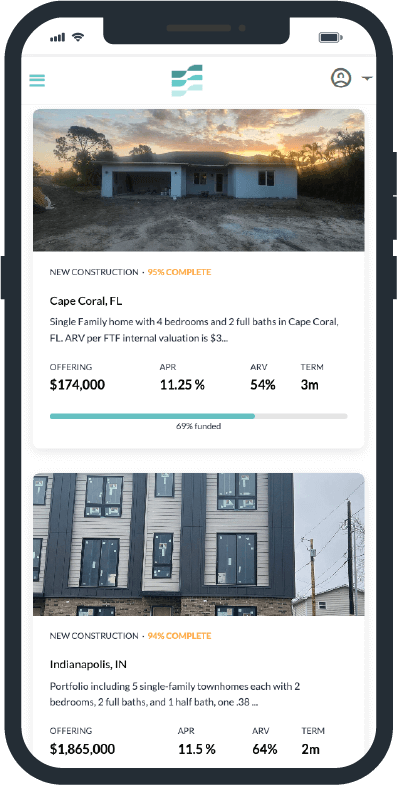

- Review and diligence the current projects open for funding.

- Start investing with project minimums of only $5,000 (or $1,000 for pooled funds)!

The investments on Upright are private placements that are made pursuant to SEC rule 506(c) of Regulation D. In order to qualify for certain filing exceptions, the SEC allows only accredited investors to participate in these types of offerings.

No. We currently do not offer a secondary market for selling purchased notes at Upright. Investors should be prepared to hold their investments to maturity, or longer in instances where the underlying note may be extended.

Yes. When your investment is approaching its maturity date, you will receive emails giving you the notification to rollover your balance or have the money paid to your bank account. Rolling over your balance into a new RBNF, PFNF, or BDN allows you to instantly invest in another offering without waiting for funds to settle.

Like any investment, there are risks involved with investing in real estate debt. There are also mitigating factors to help cushion those debts. For example, the market value of the property could drop significantly, reducing opportunity for the developer to make a profit. However, the property is most likely located in a stable market and was purchased at a discount providing downside protection in a falling-price environment. In some cases, the developer may be unable to finish the property in the allotted term length. For this situation, Upright builds in an optional 3-month extension, approved only if the project is advancing at a satisfactory pace. The extension corresponds with an additional fee to be shared on a pro-rata basis with investors. Prior to investing, you should fully diligence each deal, as well as consult your investment, tax, and legal advisors. Additional risks for each deal will be outlined with the offering materials.

Passive real estate investing is what our accredited investors do: They invest money into an asset with the expectation of generating income. It’s the traditional definition of an investment. The accredited investors time is not required to manage or operate that real estate asset. The asset (like a distressed home) is backed by a note and a first-position lien. On the flip side, active real estate investing, or what our borrowers and subscribers do, means investing both equity and time into an asset to generate income, such as being a landlord or rehabbing a home. Active real estate investors are responsible for any of the following: Sourcing properties for acquisition, getting financing, overseeing construction and contractor teams, and/or managing tenants.

Accredited investors must meet this criteria: A net worth of at least $1 million, either alone or together with a spouse or spousal equivalent (excluding the value of the person's primary residence), or earned an income that exceeded $200,000 (or $300,000 together with a spouse or spousal equivalent) in each of the prior two years, and reasonably expects the same for the current year, or A Series 7, 65, or 82 license in good standing.

When you invest in a project on Upright you are investing in a Borrower Dependent Note (BDN) or a pooled fund (such as RBNF or PFNF). The performance of the note correlates directly with the performance of the loan that Upright finances for the redeveloper of the project. The underlying loan is typically a first-position mortgage or similar security. While the note that you purchase is unsecured, the terms of your note gives you rights to the proceeds generated from the underlying note that is securing the real estate. Learn more here.

All notes as well as RBNF and PFNF have a fixed interest rate and fixed maturity date, so you have greater certainty of repayment when the project(s) is (are) complete.

Most of our products have no fees. Upright typically earns its revenue from the spread on each loan. The interest rate you see for each project is the annual interest rate you collect. The loan was likely written 1-2% points more than you see for us to service the loan.

Some of our managed funds and other products do collect a fee, which we are sure to clearly state on the deal card and in the private placement memorandum(s).

While BDNs are technically unsecured debt instruments, each debt offering is secured by a first-position lien on the underlying property (the collateral). The reason that BDNs are not technically secured is that the collateral is not pledged directly to the holder of the BDN, but rather, to the Indenture Trustee under which accredited investors benefit as BDN holders.

To limit the risk of the Company’s insolvency, the Company has granted an Indenture Trustee a security interest in all of the underlying loans corresponding to the BDNs and related payments. The Indenture Trustee may exercise its legal rights to the collateral only if an event of default has occurred under the Indenture. A complete overview of these mechanics are provided in the Private Placement Memorandum and associated investment documents.

Delaware Trust is the company serving as the Indenture Trustee. A key role of the Indenture Trustee, in addition to administrative responsibilities, is to protect the interests of investors in the BDNs. Delaware Trust and FTF Lending, LLC entered into an Indenture which is a contract between a debt issuer and a trustee that dictates the responsibilities of each party. In the case of an event of default by FTF Lending, LLC under the Indenture, the Indenture Trustee will exercise its rights for the benefit of the holders of the BDNs.

Borrowers are allowed to prepay their loans subject to a minimum number of months of interest, which they are required to pay. In the case of a prepayment, investors will receive at least this amount of interest in addition to their principal at the time of prepayment.

Under Rule 506(c) of Regulation D, the Securities and Exchange Commission (SEC) now requires companies to take reasonable steps to verify their investors are accredited. We've partnered with a reputable third-party to help verify your accreditation status through a non-intrusive verification process.

Subscribe to Our Newsletter

Sign up to receive REI news, company and performance updates, podcast episodes, and insights.